When most people think of charitable giving, they picture writing a check or making an online donation. But there’s another, often overlooked option, that not only benefits the causes you care about.Planned gifts can also provide real financial advantages for you and your loved ones: planned giving.

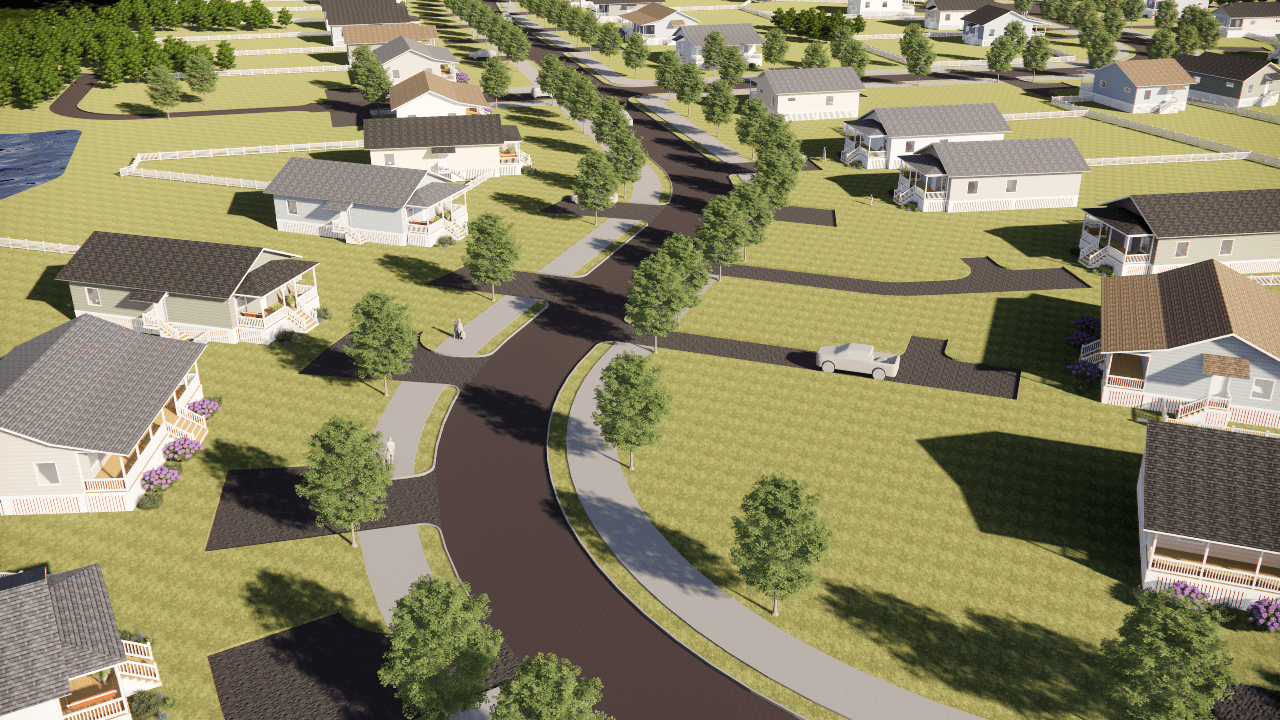

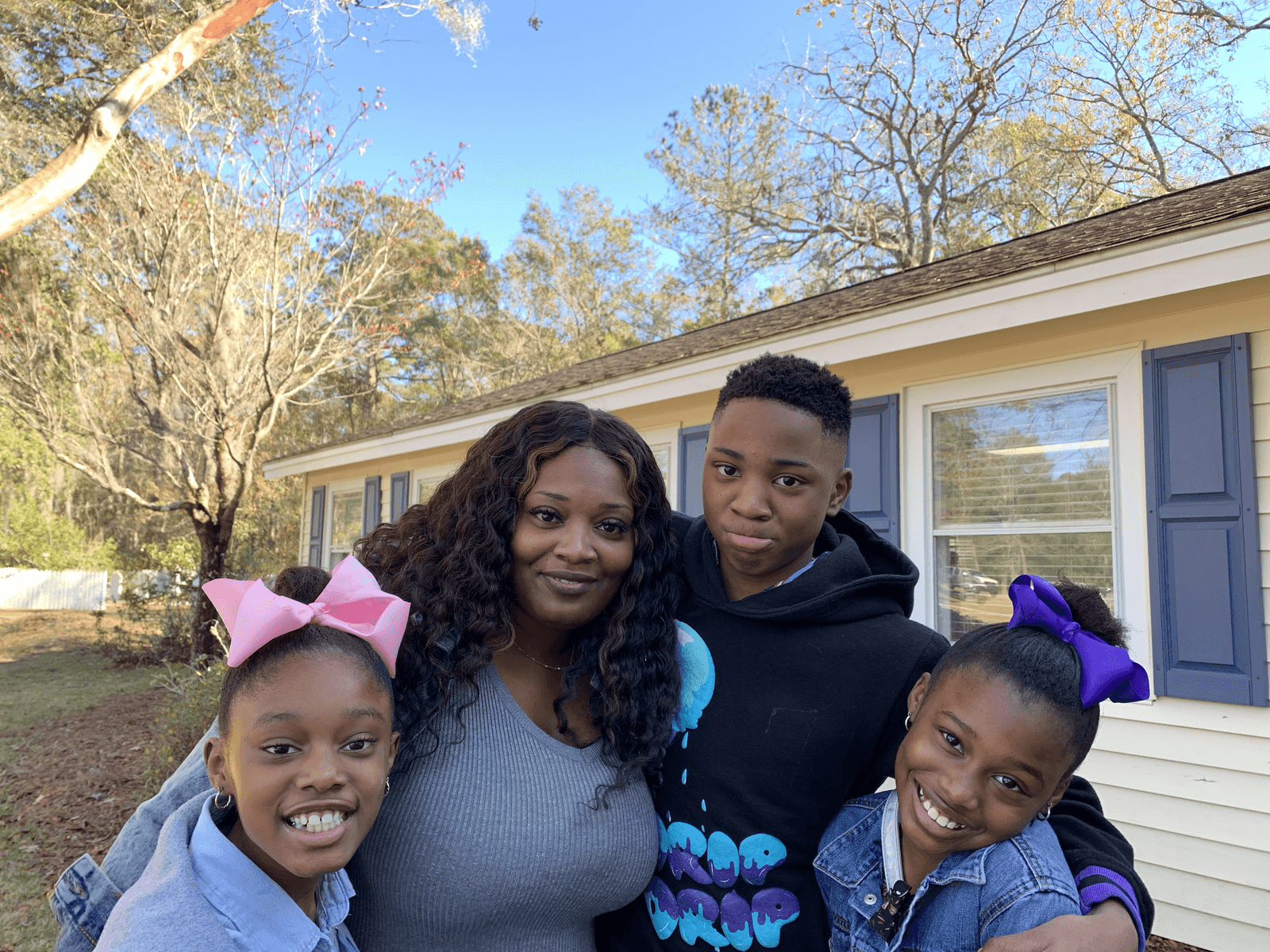

At Sea Island Habitat for Humanity, planned giving is more than a donation. It’s a lasting legacy. By including Sea Island Habitat in your estate plans, you not only help build safe, affordable homes for generations to come, but you also become a member of our Legacy Builders Society, a special group of visionary supporters who are committed to breaking the cycle of poverty and creating stable, thriving communities.

Joining the Sea Island Habitat Legacy Builders Society means your values will live on through the work you’ve helped make possible. Your generosity will be honored as a cornerstone of change, and your legacy will continue to provide strength, shelter, and hope long into the future.

Here’s how planned giving can be a smart part of your financial strategy:

1. Reduce Estate Taxes

One of the most well-known financial benefits of planned giving is its potential to reduce your estate tax liability. By leaving a portion of your estate to a qualified nonprofit organization like Sea Island Habitat, the value of that charitable gift is exempt from federal estate taxes which means more of your estate goes to causes you care about and less to taxes.

Example: If your estate is large enough to be subject to federal estate taxes, a charitable bequest can significantly reduce the taxable portion of your estate, potentially saving your heirs from a sizable tax burden.

2. Generate Lifetime Income

Certain types of planned gifts like charitable gift annuities or charitable remainder trusts allow you to receive income for life in exchange for your gift.

With a charitable gift annuity, you make a donation and receive fixed annual payments for the rest of your life.

A charitable remainder trust can provide income to you (or someone you choose) for a set number of years or for life, with the remaining assets going to Sea Island Habitat when the trust ends.

These options are ideal for individuals who want to support a cause and enjoy financial security in retirement. Legacy Builders Society members often find these tools align perfectly with their goals.

3. Lower Capital Gains Taxes

If you own appreciated assets such as stocks, real estate, or other investments, donating them directly to Sea Island Habitat through a planned giving vehicle can help you avoid capital gains taxes.

Rather than selling the asset and donating the proceeds (which would trigger capital gains taxes), donating the asset directly can allow you to:

- Bypass capital gains taxes entirely

- Receive a charitable income tax deduction for the fair market value of the asset

- Increase the impact of your gift since the full value goes to the charity

4. Income Tax Deductions

Many planned giving options also offer immediate or future income tax deductions, depending on the structure of the gift.

For example:

Donations made through a charitable lead trust may qualify for a gift or estate tax deduction

- Contributions to a charitable remainder trust or gift annuity may result in a partial income tax deduction in the year the gift is made

These deductions can help offset your tax liability, especially in years when your income is higher than usual.

5. Flexibility and Control

Planned giving allows you to structure your gift in a way that aligns with your personal, financial, and philanthropic goals. You can:

- Decide when and how the gift will be made

- Designate how the funds will be used by Sea Island Habitat

- Retain control of your assets during your lifetime (in many cases)

This level of customization is rare in traditional giving and offers peace of mind that your values and financial interests are both being honored while supporting the mission of Habitat.

Giving That Gives Back

Planned giving isn’t just for the wealthy. It’s for anyone who wants to make a thoughtful, long-term difference while maximizing the financial benefits of their generosity.

Whether you're hoping to reduce your taxes, increase retirement income, or ensure your estate is distributed according to your wishes, planned giving is a strategic tool that can help you achieve your goals and leave a lasting mark.

If you're ready to align your legacy with lasting change, we invite you to join the Sea Island Habitat Legacy Builders Society. Your commitment today builds a stronger tomorrow.

Want to learn more reach out to us at 843 768 0998 or email development@seaislandhabitat.org. We’ll help you explore your planned giving options and find the solution that’s right for you.

Because when giving is planned, everybody wins.